Financial Parenting Starts Here

Become a financially fit family and raise purposeful kids.

Financial Parenting Starts Here

Become a financially fit family and raise purposeful kids.

In the age of AI, Financial Parenting thrives on human connection.

Join a community of experts and parents alike focused on financial readiness, generational wealth stewardship, and inheritance preparation. Build a strong network to create the future you want for the next generation.

Expand Their Notions of Wealth

Abundance goes beyond money. There are all kinds of capital: financial, intellectual, social, and human (F.I.S.H.™). Bounce10 prepares kids to understand all forms of value—and how to create it.

Bounce10 Member Stories

A Focus on

Character, Capital, and Community

A creative play-based program to help parents give young children a foundation of financial readiness to serve them throughout their lives. Consider Bounce10 an experienced part of your family village, offering innovative, easy to use resources, wisdom, and guidance to turn a necessary life chore into an engaging family adventure.

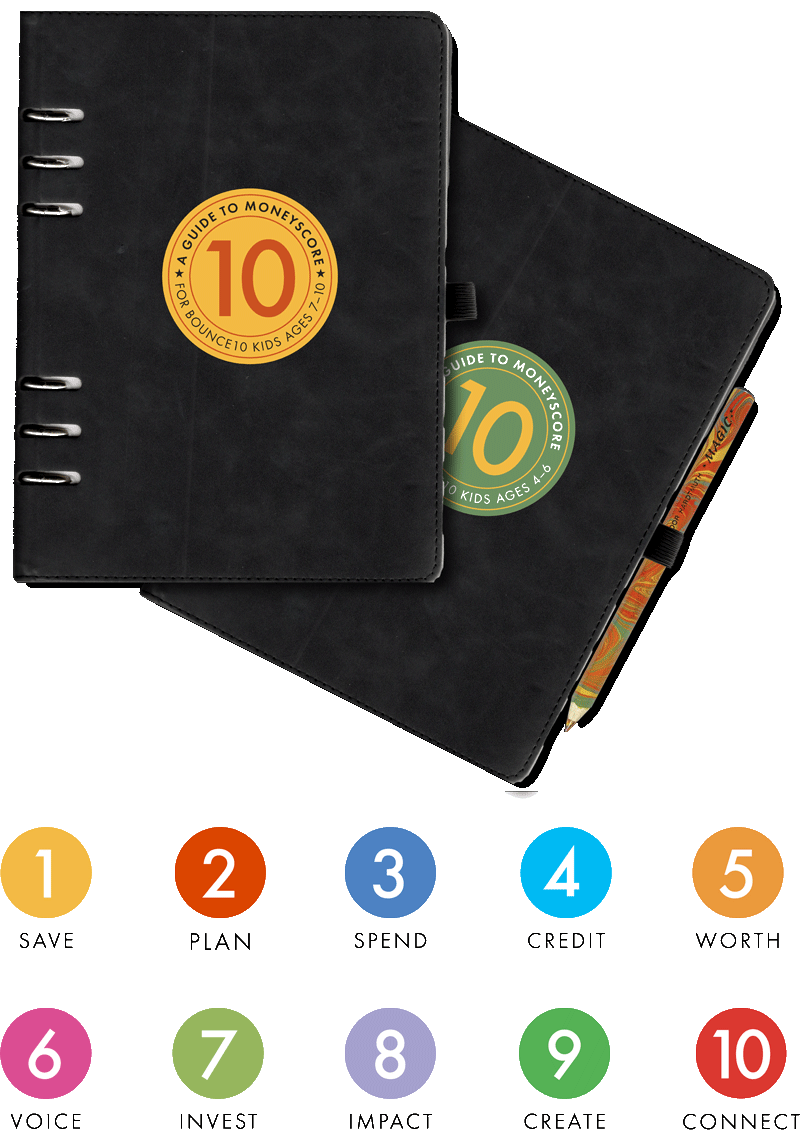

We offer programs for different ages and stages. Choose the right fit for ages 4-6 or 7-10 at checkout.

Learn the 10 Money Skills

Joline Godfrey’s Ten Money Skills present a holistic framework for developing lifelong financial confidence by teaching children that money is a practical tool tied to values, choices, and responsibility. Rather than focusing only on technical knowledge, the approach emphasizes habits such as decision-making, communication, self-discipline, and understanding personal worth, all of which evolve as children mature. Together, the Money Skills help individuals learn not just how to manage money, but how to use it thoughtfully to support independence, opportunity, and positive impact.

Many Ways to Bounce

Customized programs for families with older kids

Join our network of private school partners to launch a pilot financial education program

Built for family offices and financial advisors: explore ways to collaborate in meeting your clients’ early financial education needs

Raise Purposeful Children

Give the children in your life something money can't buy: the clarity to know what matters and the moral compass and character to pursue it with intention. Bounce10 helps your 4-10 year old develop the values, discipline, and sense of purpose that will define who they become—not what they inherit.

WE'RE HERE TO HELP YOUBOUNCE10 MEMBERSHIPA Box, a Journey, a Community

Games, puzzles, books and activities introducing skills and ideas that lead children to financial readiness arrive on your schedule

Continually refreshed activities and experiences, access to MoneyScore™ stage-based assessments, and a personal navigator to coach you through each milestone

Parents, grandparents, trusted advisors and mentors connect with one another and the Bounce10 team through web resources and live gatherings

DEEP EXPERTISE30 Years of Proven Methodology

Bounce10 founder Joline Godfrey has worked with some of the world’s wealthiest families—from UHNW multi-generational families to HNW single-child households—and continues to pioneer the movement to increase financial intelligence among young people. Her background in family businesses and social work informs a unique developmental approach to financial education that gives parents, family offices, and community leaders revolutionary tools for becoming better money mentors for kids.

LISTEN TO JOLINEA Podcast for Our (Financial Parenting) Times

In this podcast, we help parents meet the challenge of preparing children for the future. We do this by offering an expanded idea of wealth, embracing the family’s intellectual, social, and human capital as well as their financial capital, of F.I.S.H. assets as we think of them. Join us to explore financial education as Joline and her guests introduce ideas and strategies to empower, provoke, and support families preparing kids—from early childhood to young adulthood—for futures we can barely imagine.

Subscribe for free

The Results-Driven Bounce Method

Transform an essential life chore into an engaging family experience.

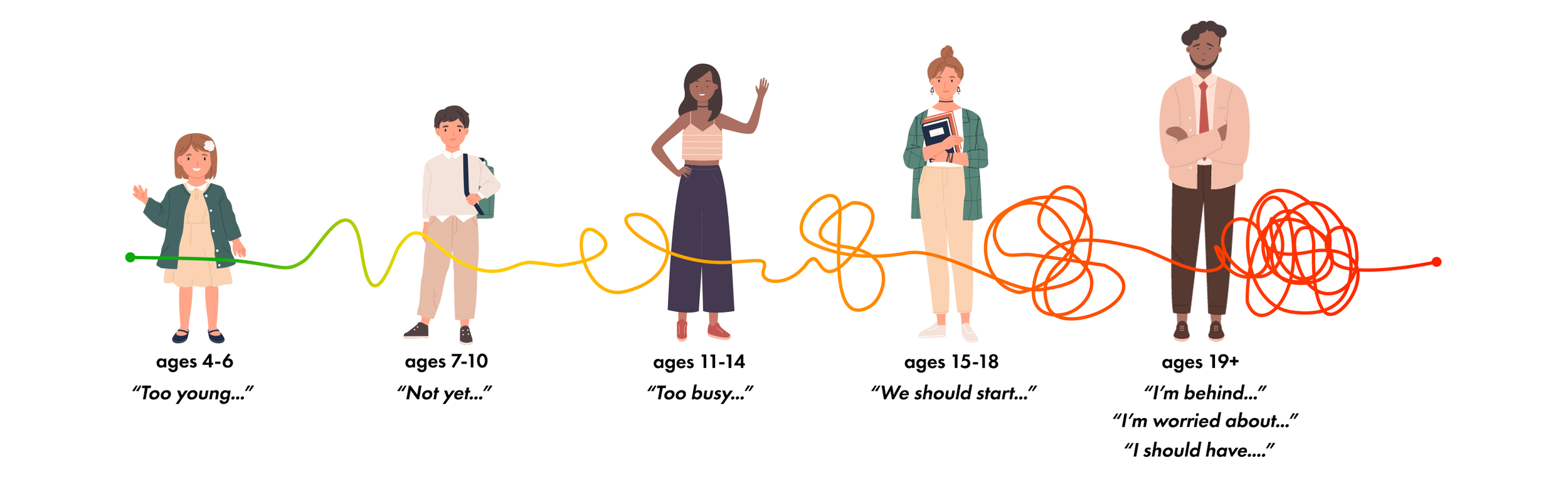

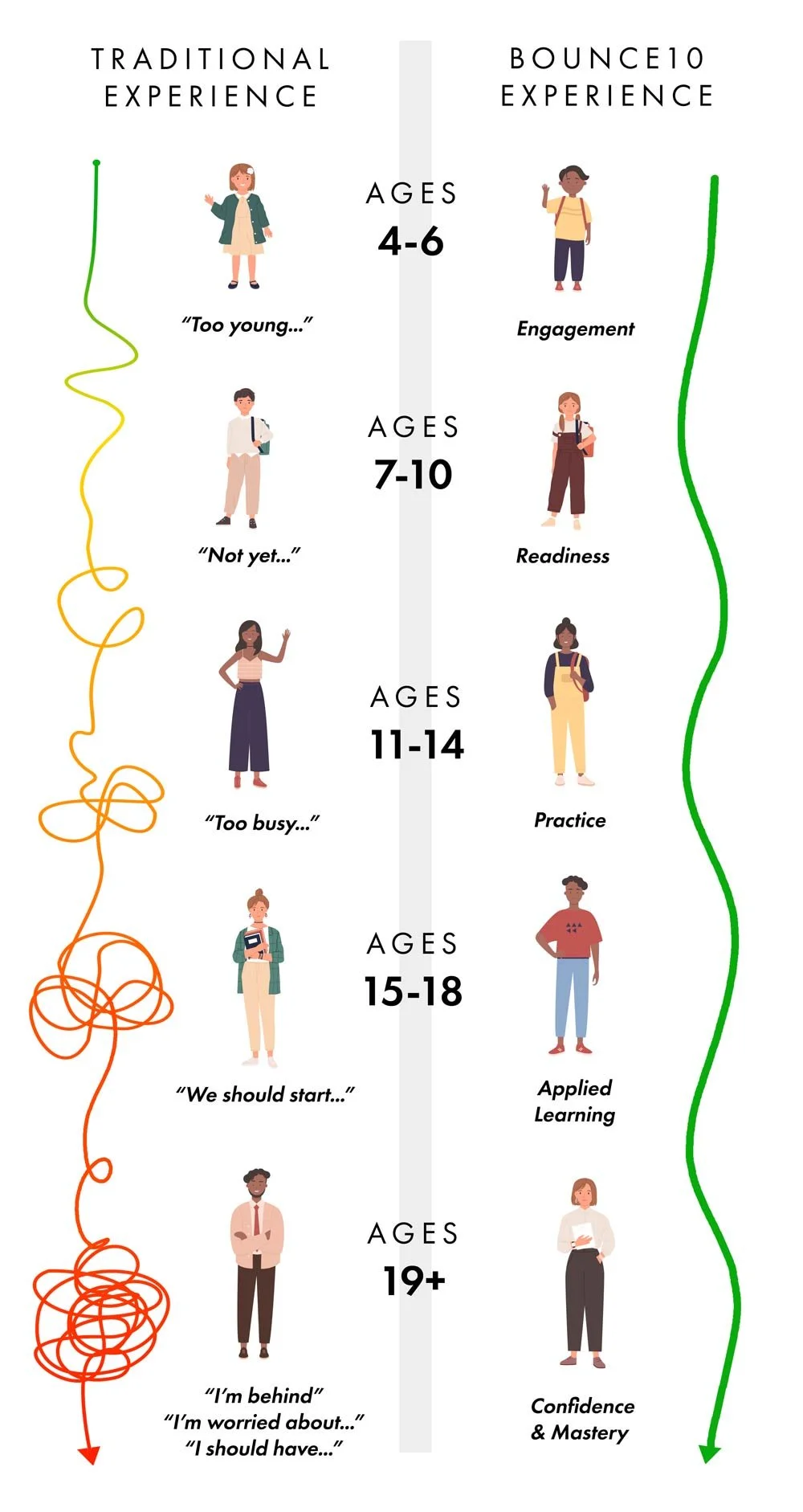

THE PROBLEM: Traditionally, parents introduce financial instruction to kids in the teen years—at the moment they most need financial fluency to navigate their increasingly complex world —forcing them to play catch up.

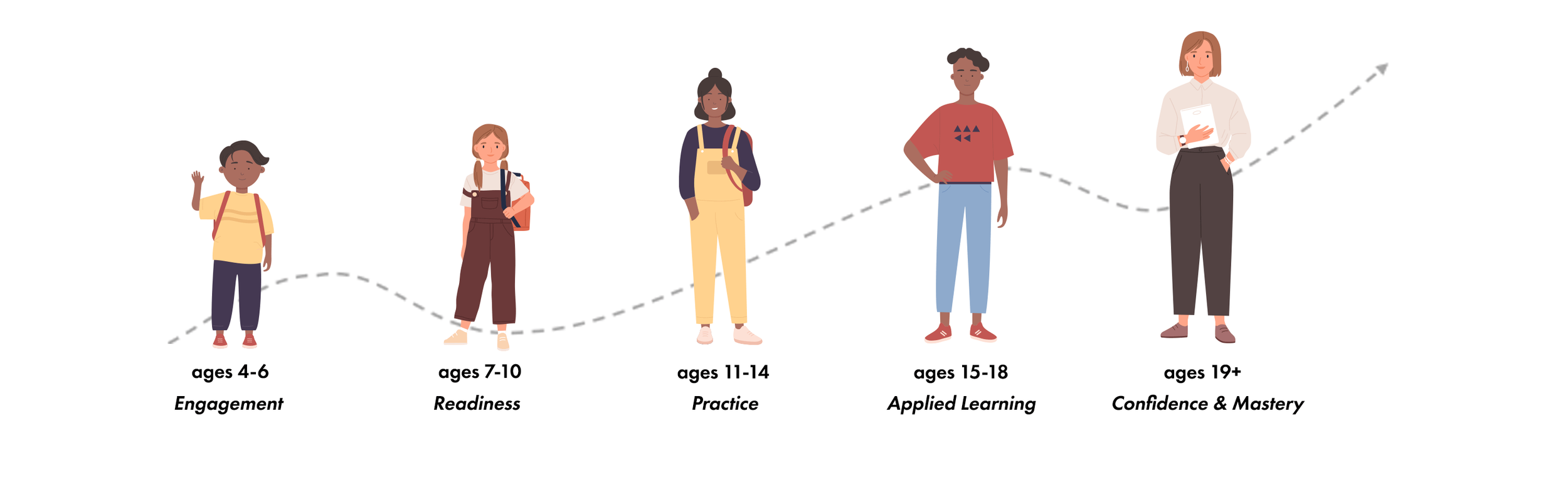

TRADITIONAL EXPERIENCETHE SOLUTION: Bounce10 gives children a head start, building a foundation for the acquisition of language and skills that will serve them throughout their developmental journey.

BOUNCE10 EXPERIENCEPsst… Beware of the Abundance Paradox:

Families face the Abundance Paradox almost daily: knowing they have the capacity to give their children everything, but realizing that every want anticipated, every need satisfied, every problem solved, and every consequence managed away is incapacitation, masquerading as care. Abundance with no guardrails robs children of the opportunities to develop resilience, agency, independence, and moral compass.